Your Guide to Small Business Start Up Costs in 2023

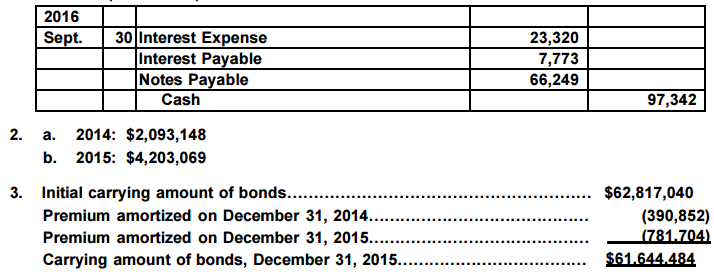

And if your startup costs were $56,000, you wouldn’t qualify for the deduction at all. The costs remaining after your deduction should be amortized (paid off over a period of time) annually in equal portions over the next 15 years. Any costs you incur before opening your doors are included in this category, except equipment, which will have to be depreciated.

With the advent of online banking, bulky bank statements are a thing of the past. Startup business owners can be a lot of things — an accountant, an attorney, a designer, a chef, a baker, or a skilled woodworker. What they usually aren’t is an experienced bookkeeper or accountant. But properly tracking your financial transactions is part of being a business owner, whether you’re a Accounting for Startup Costs startup or an established business owner. A taxpayer claims the amortization deduction on Form 4562, Depreciation and Amortization, and then carries the total deductions to the appropriate return. In Example 3, T would show the amortization deduction on Form 4562 and then carry the deduction to Schedule C, Profit or Loss From Business, of Form 1040 because T is a sole proprietor.

If you need help calculating start-up business accountant fees, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. His parents advised him to register a business so he could grow it into other apps and start making a living from it. To set up this new venture he paid $300 for an app design training, another $50 to post the app on different mobile marketplaces and he also spent $1,500 to advertise it online.

Get Started

If you and your spouse jointly own and operate an unincorporated business and share in the profits and losses, you are partners in a partnership, whether or not you have a formal partnership agreement. But know that you can often save money and time by working with a CPA. A skilled CPA will determine what you can deduct so that you pay as little as possible.

Startup costs include consulting fees and amounts to analyze the potential for a new business, expenditures to advertise the new business, and payments to employees before the business opens. Startup costs do not include costs for interest, taxes, and research and experimentation (Sec. 195(c)(1)). The different book and tax treatment is reconciled on an attachment to the federal tax return using Schedule M-1, Reconciliation of Income (Loss) per Books With Income per Return. Startup costs are expenses that a business incurs before it generates any revenue.

Professional development & education

From there, estimate how much cash you’ll need moving forward until you hit a steady break-even point several months and even years after opening. You may see experts who recommend having anywhere from six months to a year’s worth of expenses covered, with your starting cash. That’s nice in concept and would be great for peace of mind, but it’s rarely practical. And it interferes with your estimates and dilutes their value. There’s a reason that you should separate costs into assets and expenses.

You need to get the information you need to make decisions and to ensure the utmost of financial health. Kruze’s team of professional bookkeepers will work with you to find the financial delivery date that meets your needs. The research and development, or R&D tax credit, is a US government-sponsored incentive that rewards companies for conducting research and development activities within the United States. Even unprofitable technology companies can use this incentive to reduce their burn rate. Kruze has helped clients reduce their burn rates by over $40 million through our work on this government incentive program. We’ve put together the ultimate finance and HR due diligence checklist for startups.

File

If you file Schedule C (Form 1040), use Form 8829, Expenses for Business Use of Your Home. However, if you elect to use the simplified method, use the Simplified Method Worksheet in the Instructions for Schedule C or Pub. You do not meet the requirements of the exclusive use test if you use the area in question both for business and for personal purposes. Business property you must depreciate includes the following items. To get the payee’s SSN or EIN, use Form W-9, Request for Taxpayer Identification Number and Certification.

As in the journal, he keeps each major expense in a separate column. You must keep your business records available at all times for inspection by the IRS. If the IRS examines any of your tax returns, you may be asked to explain the items reported. You usually recover costs for a particular asset (such as machinery or office equipment) through depreciation (discussed next). However, you can elect to deduct up to $10,000 of business start-up costs and up to $5,000 of organizational costs.

Startup expenses are divided into one-time and ongoing expenses. You can generally get some tax deductions for your startup expenses, depending on the tax laws in your state. These records must support the income, expenses, and credits you report. Generally, these are the same records you use to monitor your business and prepare your financial statements. An accounting method is a set of rules used to determine when and how income and expenses are reported.

Insurance ($46–$86 per Month, per Policy)

As a new business owner, you need to know your federal tax responsibilities. Ask yourself each question listed in the table, then see the related discussion to find the answer. Just make sure you’re not maxing out your credit card or charging more than you can repay. Both can harm your credit score, which might hurt your chances of securing a small business loan down the line. The application is simple, and a business credit card is usually easier to qualify for than a traditional business loan.

For example, if your business is remote, you likely won’t need to print flyers every month. Some marketing costs can be a one-time cost like designing your website or having business cards created. Utilities are one of the essential expenses that you will have to take care of when you establish your business. These costs include gas, electricity, water, phone, and internet bills for your business space. Depending on where you live, you might need to pay for additional utility expenses like HVAC units. If you’ve taken a small business loan to start your business, you’ll need to set aside a portion of your profits to make loan payments.

What do prospective clients consider when deciding how to choose an accountant? What do they look for in a CPA?

Although that chapter does not give CPAs an

all-inclusive list of the costs that should be capitalized as

inventory, paragraph 5 does provide some guidance. As in fixed asset

accounting, many entities use textbooks and established industry

practice to determine capitalizable inventory costs. You can now file Form 1040-X electronically with tax filing software to amend 2019 Forms 1040 and 1040-SR. See Tips for taxpayers who need to file an amended tax return and go to IRS.gov/Form1040X for information and updates. He enters the total of other annual business expenses on the “Other expenses” line of Schedule C.

Why You Need a Separate Credit Card for Business Expenses Chase – Chase News & Stories

Why You Need a Separate Credit Card for Business Expenses Chase.

Posted: Tue, 18 Jul 2023 15:59:53 GMT [source]

It is wise to hire the services of a CPA to properly evaluate your business’s taxes, your income taxes, and returns for the fiscal year. If you’re working to get your own business up and running, it’s crucial to understand the different costs you might encounter. Knowing potential business startup costs upfront makes you better prepared as an entrepreneur and can improve your odds of success.

Office space: $100 to $1,000 per employee per month

The following penalties apply if you are required to file information returns. For more information, see the General Instructions for Certain Information Returns. Any business that has a federal tax obligation and requests a new EIN will automatically be enrolled in EFTPS. Through the mail, the business will receive an EFTPS PIN package that contains instructions for activating its EFTPS enrollment.

- Under the General Accounts column, he enters small expenses that normally have only one or two monthly payments, such as licenses and postage.

- An individual with the desire to start a business has to pay for many previous expenses long before it starts producing any money.

- In that case, you might have to invest in making appropriate improvements to the site, including installing industrial-grade ovens, countertops, and other relevant upgrades.

- The cost of hiring a financial professional differs according to each small business’ unique accounting situation.

So we don’t recommend that level of complexity for your seed stage model – just the IS and the cash position (maybe working capital or inventory). Scaling a startup is hard work – but scaling financial and HR backend systems shouldn’t be. The best startup accountants have worked with multiple high-growth companies, and know which software and systems are ready for hyper growth. The more accurately you layout startup costs and make adjustments as you incur them, the more accurate vision you’ll have for the immediate future of your business. For a better estimate of what you really need in your starting cash balance, you calculate the deficit spending you’ll likely incur during the early months of the business.

States with community property laws include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. It’s prudent to cover six months’ worth of expenses minimum upfront; this financial cushion will support you in your business’s early stages when your profit margins might be slim. Services like Stamps.com can ease the burden of shipping costs on small business owners. With this service, you can print postage without having to buy a costly postage meter.

There are no comments